#boost debt reduction

Explore tagged Tumblr posts

Text

Help Stop Trump's "Big Beautiful Bill"

House Committees have been working on completing their individual portions of the budget reconciliation bill that Republicans are pushing through to enact hefty tax cuts for the wealthy and corporations. To pay for these tax cuts—and take advantage of the filibuster-proof reconciliation procedure—Republicans are including many spending cuts and policy changes from their partisan wish list.

In addition to gutting Medicaid, boosting ICE funding and green lighting the sale of public lands for fossil fuel production, these harmful provisions include:

$351 billion in cuts to student aid. This includes new limits on Pell Grant eligibility, new caps on how much a student can borrow, roll backs of protections from predatory lenders, and a repeal of President Biden’s student debt forgiveness program.

$50 billion in cuts to the Federal Employee Retirement System, including significant reductions in take-home pay, retirement benefits, and protections against unjust treatment for federal workers.

Slashes to funding for the Consumer Financial Protection Bureau (CFPB) by nearly 70% and a complete dissolution of the Public Company Accounting Oversight Board, the government’s top watchdog of public company audits.

A widespread roll back of climate-focused programs and clean energy tax incentives authorized by the 2022 Inflation Reduction Act, including the elimination of EV tax credits, the Greenhouse Gas Reduction Fund, and countless other grants that have led to $630 billion in new business investments and jobs.

A $300 billion funding cut and stringent new work requirements for SNAP, the food assistance program that helps over 42 million low-income people nationwide.

Language pulled from the REINS Act, a long-time Republican goal, that would give Congress new control over federal rule making. This would make it easier for Republicans to roll back any regulation they don’t like, including those that have already been finalized and implemented.

A limit to federal judges’ authority to hold government officials in contempt of court. A move clearly designed to defend the Trump administration from accountability for defying the courts.

Once all committee work is complete, the House and Senate will both need to approve and vote on the full reconciliation bill. House Republicans are aiming for a floor vote by Memorial Day weekend.

What is worse is that the GOP is planning to advance the bill even further at 1 a.m. to avoid attention.

Call your Reps and demand they oppose this destructive bill.

These are scripts to various aspects of the bill:

This one below is a more general version:

The rest are more specific to certain provisions of the bill, call them as well under the Big Bueatiful Bill Act: https://5calls.org/all/

Fax Tool:

Find your legislator:

#aclu#us politics#fuck project 2025#stop internet censorship#lgbtq+#american politics#fuck donald trump#stop project 2025#stop bad bills#fight for the future#save medicaid#save our national parks#save the environment#enviromentalism#queer rights#queer community#civil rights#authoritarianism#Stop Trump#anti ai

40 notes

·

View notes

Text

This is why, for all years of promising to boost consumption, it has been so hard for China to make much progress. It has to raise the household share of GDP by ten percentage points at the very least, which of course means an equivalent reduction of someone else's share.

Many analysts insist that China will choose to avoid rebalancing altogether, but they miss the point. These levels of imbalance simply cannot be sustained if neither China nor the rest of the world can absorb the growing gap between consumption and production.

China will rebalance one way or another. The important question is how it rebalances: whether an increase in the household share of GDP will occur in the form of a debt crisis and a sharp contraction in GDP, as occurred in the US in the early 1930s, or of many years of stable consumption growth and much lower GDP growth, as occurred in Japan after 1990, or of a surge in consumption that keeps GDP growth stable (which would be historically unprecedented). These are arithmetically the only three ways to rebalance.

33 notes

·

View notes

Text

The issue around treating medical school debt as a driver for problems of US doctor shortages, or distortions in distribution, is that any impact it has is just completely wiped out by the centrally controlled, government-backed reductions in the supply of doctors themselves. In a world where the supply of doctors was allowed to meet demand, debt would matter a good deal! It would be reducing your supply, making the marginal cost of becoming a doctor higher, and so reductions in the price of becoming one would boost the numbers you have, lower costs of treatment, etc etc.

But in the US that's all irrelevant because we slap a gigantic quota bar a thousand yards before those supply and demand lines ever intersect. You could demand blood sacrifices and the souls of their first born from med school applicants, demand for those slots is so high you wouldn't even notice. Being a doctor is the most reliable 1%'er job in the US at scale, it beats programmers and financial analysts easy. Any attempt to "boost supply" of doctors by making being a doctor *better* somehow is categorically incapable of doing that, because that is not what is constraining supply. Even the idea of boosting the salaries of pediatricians to get relatively more of them, while it can do something at the margins, is missing the point - your supply of doctors is fixed. You can only increase the number of pediatricians by *reducing the number of radiologists*. Who presumably do valuable work! The math is extremely harsh to any attempts at amelioration if you don't address the core problem.

136 notes

·

View notes

Text

The Bill and Melinda Gates Foundation is a major influencer and funder of agricultural development in Africa, with little accountability or transparency. Leading experts in food security and many groups in Africa and around the world have critiqued the foundation’s push to expand high-cost, high-input, chemical-dependent agriculture in Africa. Critics say this approach is exacerbating hunger, worsening inequality and entrenching corporate power in the world’s hungriest region.

This fact sheet links to reports and news articles documenting these concerns.

[...]

What are the main critiques of Gates Foundation’s agricultural program?

The Gates Foundation’s flagship agricultural program, the Alliance for a Green Revolution in Africa (AGRA, which recently rebranded to remove the term “green revolution” from its name), works to transition farmers away from traditional seeds and crops to patented seeds, fossil-fuel based fertilizers and other inputs to grow commodity crops for the global market. The foundation says its goal is to “boost the yields and incomes of millions of small farmers in Africa… so they can lift themselves and their families out of hunger and poverty.” The strategy is modeled on the Indian “green revolution” that boosted production of staple crops but also left a legacy of structural inequity and escalating debt for farmers that contributed to massive mobilizations of peasant farmers in India.

Critics have said the green revolution is a failed approach for poverty reduction that has created more problems than it has solved; these include environmental degradation, growing pesticide use, reduced diversity of food crops, and increased corporate control over food systems. Several recent research reports provide evidence that Gates-led agricultural interventions in Africa have failed to help small farmers. Critics say the programs may even be worsening hunger and malnutrition in Southern Africa.

34 notes

·

View notes

Text

The papers all cover the government's framework budget settlement, which was announced late on Wednesday evening.

MTV has a list of the decisions. They include cuts to higher education funding, development aid and municipalities. There are also big income tax breaks targeted at higher earning taxpayers, a higher threshold for paying inheritance tax, and corporate tax reductions to benefit Finland's companies.

The tax cuts are an expensive measure, and to stay compliant with the government's goal of stabilising the state budget by 2027 ministers agreed to take a billion euros out of the state pension fund to cover a likely shortfall in the 2027 state budget.

Iltalehti carries criticism of that plan from an economist at the VATT Institute for Economic Research who likens the move to taking out a payday loan.

What changed?

Helsingin Sanomat has analysis of the budget and in particular the shift in government rhetoric around state debt.

Last November Finance Minister Riikka Purra (Finns) had said that there was no room for tax cuts, as the state finances and the wider economy were in such poor shape.

Now the tune has changed, and the so-called dynamic feedback created when you cut taxes for high earners is expected to boost the economy.

That is contested, with many economists and opposition politicians arguing that the research does not support such reliance on growth to finance future outgoings.

And even in the optimistic scenarios published by the Finance Ministry, there is a time lag between the tax reductions going into force and the economic benefits being felt.

The prime reason for the decisions, according to HS, is political. Government parties had agreed that they would make difficult decisions and cuts in the first two years of the government, and then have a chance to give tax cuts once the economy had revived.

That revival is yet to be seen, but the government is sticking to the plan anyway. One reason could be that the plan to stabilise the finances is now delayed until the end of the decade anyway, thanks in part to increased defence spending.

Former Finns Party operative in Murmansk

Iltalehti reports on Sakari Linden, a former Finns Party official who was recently in Murmansk for Russia's International Arctic Forum, where he gave a speech in English that was broadcast on Russia Today.

He was also interviewed by a Finnish Putin propagandist, Janus Putkonen, who posted pictures of the meeting on his social media channels.

Putkonen has spent time in the occupied Donbas region in Ukraine, publishing content in Finnish from the Russian perspective.

The Murmansk conference was attended by Russian President Vladimir Putin, who spoke of his plans for the militarisation of the Arctic, and increasing Russian military capabilities in the region.

The Lithuanian intelligence agency has stated that attendees in Murmansk are often targeted for recruitment by Russian security services. Linden denied that he had been approached in Russia.

Linden has served as Laura Huhtasaari's (Finns) special advisor when she was an MEP, and written on EU policy for the Finns Party's think tank. He currently says he is a "geopolitical analyst" and consultant living in Brussels.

Linden told IL that he is an "independent thinker" and went to Murmansk in that spirit.

"Finns are in the midst of a powerful Russia hysteria, and they are subject to huge social pressure," said Linden. "I'm not interested in pressure from fanatics. I would like to say that Finland should have its own view and connections to all power centres, including Russia."

Linden has criticised the Finns Party leadership as "globalist", and told IL that he currently has no connection with the party.

3 notes

·

View notes

Text

What the Republican budget plan means for the IRA. (Heatmap AM)

House Republicans passed a budget blueprint Thursday that lays the groundwork for the party to begin drafting legislation to enact President Trump’s agenda. Now the fight over the Inflation Reduction Act’s clean energy tax credits begins in earnest. As Heatmap’s Emily Pontecorvo explains, the blueprint is a set of instructions for writing the eventual budget bill, laying out topline numbers for tax cuts and spending reductions — it doesn’t contain any actual policies. Trump’s biggest priorities are to extend the tax cuts he enacted in 2017, pass new tax cuts on tips and overtime pay, and to boost spending on immigration control and defense.

The resolution Republicans passed allows for all of the above. In total, it enables Congress to craft a bill that would increase the national debt over the next decade by more than $5 trillion. “The good news for the IRA tax credits is that the framework only requires lawmakers to craft legislation that would produce $4 billion in savings,” says Pontecorvo. “The bad news is that Senate Republicans have given their word to budget hawks in the House that they will aim to produce a minimum $1.5 trillion in savings. House Republicans are eager to find at least $2 trillion in deficit reductions.”

On Thursday, Republican Senators Lisa Murkowski of Alaska and John Curtis of Utah sent a letter to their party’s leadership asking them to preserve IRA tax credits that spur manufacturing, reduce energy costs for consumers, and give certainty to businesses that have already made investments in the U.S. based on the credits. Thom Tillis of North Carolina and Jerry Moran of Kansas also signed the letter. It was the first major show of support for the tax credits in the Senate, following a similar letter signed by 21 Republicans in the House.

2 notes

·

View notes

Text

Why Lula is suddenly concerned about Brazil's public spending

President Luiz Inácio Lula da Silva is reinforcing Brazil’s commitment to fiscal consolidation in response to investors' concerns.

During a prime-time speech that was widely broadcast on Sunday, Lula said, "I will not abandon fiscal responsibility. Among the many life lessons I received from my mother... I learned not to spend more than I earn."

After taking office in January 2023, Lula repeatedly promoted increased public investment to boost growth. However, investors have raised concerns as higher spending could create inflationary pressure.

"From the beginning of the Lula administration, domestic investors were suspicious that the government's fiscal strategy was limited because it anchored the debt reduction to an increase in revenue from tax collection and not a reduction in expenses. Now, this strategy is also being doubted by international investors, who have taken resources out of Brazil because of an increase in risk perception, which forces the government to adopt a more assertive tone in relation to its fiscal commitment," Luciano Rostagno, chief strategist at EPS Investimentos, told BNamericas.

Continue reading.

6 notes

·

View notes

Text

Tips on How to Pay Off Your Home in 7 Years or Less

Meta Description: Learn practical tips on how to pay off your home in 7 years or less. Discover mortgage reduction strategies, extra payment tips, and budgeting methods to become mortgage-free faster.

Introduction: Why Pay Off Your Home Early?

Paying off your mortgage faster not only saves you tens of thousands in interest but also provides unmatched financial freedom. If you’re looking for ways to eliminate your home loan and build equity quickly, this guide offers proven tips on how to pay off your home in 7 years or less—without refinancing or taking extreme measures.

With smart budgeting, strategic payments, and discipline, you can turn your 30-year mortgage into a 7-year success story.

1. Make Biweekly Payments Instead of Monthly

Switch from monthly to biweekly mortgage payments. You’ll end up making one extra full payment per year (26 half-payments = 13 full payments), which can shave off years and thousands in interest.

Pro Tip:

Set this up automatically with your lender to stay consistent.

2. Round Up Your Payments

Instead of paying your minimum mortgage amount, round up to the nearest hundred. For example, if your monthly mortgage is $1,430, pay $1,500. That extra $70/month adds up to $840 a year—and compounds as principal is reduced faster.

3. Use Windfalls and Bonuses Strategically

Tax refunds, work bonuses, or side hustle income can all be applied toward principal-only payments. Every time you make a lump sum payment, it reduces your loan balance and saves interest.

4. Cut Unnecessary Expenses and Redirect Savings

Track your spending and cut non-essential expenses such as streaming subscriptions, dining out, or luxury purchases. Redirect those funds to your mortgage payment.

Example:

Saving $200/month on discretionary spending and applying it to your mortgage = $2,400/year in extra payments.

5. Refinance to a Shorter Term (If It Saves You Money)

If rates are low and you qualify, refinancing to a 10- or 15-year mortgage can reduce your interest rate and speed up payoff. Just be sure your new monthly payment fits your budget without stretching your finances thin.

6. Make a Large Initial Payment or Recast Your Loan

If you’ve received a large sum (inheritance, investment return, or home sale), apply it toward your mortgage and recast your loan. Recasting lowers your monthly payment while keeping the same term—allowing you to pay off the loan faster if you continue higher payments.

7. Use the 1/12 Rule

Each month, pay an extra 1/12th of your mortgage toward the principal. At the end of the year, you’ll have made an additional full payment, accelerating your payoff without overburdening your monthly budget.

8. Increase Payments When Income Increases

Any time you get a raise, increase your mortgage payment by the same percentage. For example, a 5% raise = 5% more toward your monthly mortgage. Keep your lifestyle modest and use the income boost to kill your debt faster.

9. Track Your Progress Monthly

Use a mortgage amortization calculator or spreadsheet to track how much time and interest you’re shaving off. Watching your principal drop is highly motivating.

10. Stay Consistent and Avoid New Debt

Consistency is key. Avoid taking on new loans or using credit cards excessively. Keep your focus on debt reduction and you’ll hit your 7-year goal faster than you think.

Final Thoughts: Own Your Home and Your Future

These tips on how to pay off your home in 7 years or less are practical, actionable, and proven to work. With commitment, a little creativity, and financial discipline, you can break free from mortgage debt, build equity quickly, and live with peace of mind knowing your home is truly yours.

Start today—every extra dollar counts.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also Enhanced Credit Repair ($249 Per Month) and Passive income programs (Can Make 5-10% Per Month; Trade $100K of Someone Esles Money).

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Target Keywords Used:

tips on how to pay off your home in 7 years or less

biweekly mortgage payments

pay off mortgage faster

mortgage reduction strategies

how to become mortgage-free

Learn More:

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#tips on how to pay off your home in 7 years or less#biweekly mortgage payments#pay off mortgage faster#mortgage reduction strategies#how to become mortgage-free

1 note

·

View note

Text

What Are the Advantages of Bi-Weekly Loan Payments?

Introduction

Managing a personal loan effectively requires a strategic repayment approach. One such strategy that has gained popularity is bi-weekly loan payments. Instead of making monthly payments, borrowers make payments every two weeks, which can result in faster loan repayment and lower interest costs. But how exactly does this work, and what are the key benefits?

In this article, we’ll explore the advantages of bi-weekly personal loan payments, how they work, and whether this method is suitable for your financial goals.

How Do Bi-Weekly Loan Payments Work?

A standard loan repayment schedule involves making monthly payments over the loan tenure. With a bi-weekly repayment plan, borrowers make half of their monthly installment every two weeks. Since there are 52 weeks in a year, this results in 26 half-payments, which equals 13 full monthly payments instead of 12.

This extra payment reduces the principal balance faster, leading to potential savings on interest and a shorter loan tenure.

Key Advantages of Bi-Weekly Loan Payments

1. Faster Loan Repayment

One of the biggest benefits of bi-weekly payments is that you effectively make an extra monthly payment every year. This additional payment helps to reduce the principal amount, allowing borrowers to repay their personal loan faster than with a standard monthly schedule.

2. Significant Interest Savings

By reducing the principal balance more frequently, borrowers pay less interest over the life of the personal loan. Since interest is calculated on the outstanding balance, paying down the loan faster minimizes the amount on which interest accrues.

3. Improved Financial Discipline

Bi-weekly payments encourage a structured approach to debt repayment. Since payments are made every two weeks, it aligns well with the payroll cycle for many employees, making it easier to manage finances without accumulating excess debt.

4. Reduced Financial Strain

Smaller, more frequent payments can be easier to handle than a single large payment at the end of the month. This reduces financial stress and helps borrowers stay on top of their repayment schedule.

5. Potential Credit Score Boost

Consistently making timely payments on a personal loan can improve a borrower’s credit score. Since bi-weekly payments ensure regular and timely reductions in outstanding debt, it can positively impact creditworthiness over time.

Example of Interest Savings with Bi-Weekly Payments

To illustrate the savings from bi-weekly payments, let’s assume the following loan details:

Loan Amount: $20,000

Interest Rate: 10% per annum

Loan Tenure: 5 years (60 months)

If the borrower follows a traditional monthly repayment plan, they will make 60 payments over five years. However, under a bi-weekly payment plan, the borrower makes an extra payment each year, reducing both the tenure and interest paid.

This simple adjustment can help save hundreds or even thousands of dollars in interest over the course of the loan.

Considerations Before Opting for Bi-Weekly Payments

While the benefits of bi-weekly personal loan payments are clear, there are some factors borrowers should consider before switching:

1. Check with Your Lender

Not all lenders offer bi-weekly repayment options. Some financial institutions may require additional fees or impose restrictions on modifying loan repayment schedules.

2. Understand Prepayment Penalties

Certain lenders impose prepayment penalties if borrowers pay off their loans earlier than scheduled. It’s essential to confirm whether making additional payments will incur extra charges.

3. Budget Accordingly

While bi-weekly payments reduce overall loan costs, borrowers should ensure they can manage their cash flow effectively. Making payments every two weeks requires proper budgeting to avoid financial strain.

4. Automatic Payment Enrollment

Setting up automatic payments with the lender can help ensure timely bi-weekly payments, reducing the risk of missed payments and late fees.

Alternatives to Bi-Weekly Loan Payments

If your lender does not support bi-weekly payments, there are alternative strategies to achieve similar results:

1. Make Extra Lump Sum Payments

Borrowers can choose to make an extra payment once a year or periodically increase their monthly payments to reduce their loan balance faster.

2. Round Up Your Payments

Another simple approach is to round up your payments. For example, if your EMI is $450, consider paying $500 instead. The extra $50 goes toward the principal, reducing the overall interest burden.

3. Consider Refinancing for Better Terms

If you are unable to modify your payment schedule, refinancing your personal loan with another lender offering flexible payment options can be a good alternative.

Frequently Asked Questions (FAQs)

1. Can I set up bi-weekly payments on any personal loan?

Not all lenders offer this option. Check with your lender to see if they support bi-weekly repayment plans.

2. How much money can I save with bi-weekly payments?

Savings vary depending on the loan amount, interest rate, and tenure. However, most borrowers save a significant amount in interest and shorten their repayment period.

3. Do bi-weekly payments count as two separate payments?

No. Most lenders apply bi-weekly payments as partial payments toward the monthly installment. However, since you make 26 half-payments (13 full payments) in a year, you end up paying off your loan faster.

4. Will bi-weekly payments improve my credit score?

Yes. Making consistent payments reduces the risk of late fees and defaults, which can improve your credit score over time.

5. Is there a downside to bi-weekly loan payments?

The primary drawback is the need for proper budgeting, as payments occur more frequently. Additionally, some lenders charge fees for modifying payment schedules.

Conclusion

Switching to bi-weekly payments can be an excellent strategy for paying off a personal loan faster while saving on interest costs. This repayment method offers numerous benefits, including lower total interest, improved financial discipline, and reduced loan tenure. However, borrowers should check with their lender for feasibility and any potential fees associated with this option.

By making small, frequent payments, borrowers can take control of their debt, improve their credit score, and achieve financial freedom sooner.

#personal loan online#loan apps#nbfc personal loan#personal loan#fincrif#personal loans#bank#loan services#finance#personal laon#Personal loan#Bi-weekly loan payments#Loan repayment strategy#Personal loan interest#Extra loan payment#Loan amortization#Faster loan repayment#Lower interest payments#Debt reduction#Personal loan EMI#Loan repayment plan#Credit score improvement#Personal loan savings#Prepayment penalty#Loan tenure reduction#Interest savings#Loan budgeting#Monthly vs. bi-weekly payments#Loan payment frequency#Lump sum loan payment

1 note

·

View note

Text

Mastering Your Finances: A Roadmap to Long-Term Financial Health

Introduction

Achieving financial stability is a crucial step toward a secure and stress-free life. Effective financial management enables you to avoid debt, save for the future, and make informed investment decisions. In this comprehensive guide, we will explore practical tips and strategies to help you master your finances and achieve long-term financial health.

Section 1: Building a Strong Financial Foundation

A solid financial foundation is akin to the bedrock of a grand architectural marvel. Without it, the structure above cannot stand tall and resilient against the test of time.

Spend Less Than You Earn The cornerstone of financial stability lies in the principle of spending less than you earn. Much like the conservation of energy, where output should not exceed input, your financial health thrives when your expenditures are less than your income. Begin by meticulously tracking your expenses. Utilize tools like budgeting apps or a simple spreadsheet to categorize and monitor every dollar spent. Create a budget that aligns with your financial goals, allowing you to live within your means and avoid unnecessary debt.

Emergency Fund An emergency fund serves as your financial safety net, a buffer against life's unpredictable events. Aim to save 3-6 months' worth of living expenses in an easily accessible account. This fund acts as a safeguard, ensuring you can navigate unexpected expenses, such as medical bills or car repairs, without derailing your financial progress. The importance of this fund cannot be overstated, as it provides peace of mind and stability in turbulent times.

Section 2: Investing Wisely

Investing is the art and science of making your money work for you. However, like any scientific endeavor, it requires careful research, understanding, and strategic planning.

Understand Before You Invest Before diving into the world of investments, take the time to understand the various options available. Whether it's stocks, bonds, real estate, or other assets, each investment vehicle comes with its own set of risks and rewards. Conduct thorough research and consider seeking advice from a financial advisor. Their expertise can provide valuable insights and help you make informed decisions.

Don't Invest More Than You Can Afford to Lose A cardinal rule in investing is to never put at risk more money than you can afford to lose. Diversification is your ally in mitigating risk. Spread your investments across different asset classes and sectors to minimize the impact of any single investment's poor performance. This approach, known as diversification, enhances the stability and potential growth of your portfolio.

Section 3: Managing Debt Effectively

Debt, if managed wisely, can be a tool for growth. However, if left unchecked, it can become a burden that stifles financial progress.

Good Debt vs. Bad Debt Not all debt is created equal. Good debt, such as student loans or mortgages, can be considered investments in your future. They often come with lower interest rates and have the potential to increase your earning power or net worth. Conversely, bad debt, like high-interest credit card debt, can quickly spiral out of control. Focus on paying off high-interest debt first to free yourself from its financial stranglehold.

Debt Reduction Strategies There are several effective strategies for reducing debt. The snowball method involves paying off your smallest debts first, providing a psychological boost as you eliminate balances one by one. The avalanche method focuses on paying off debts with the highest interest rates first, saving you money on interest over time. Consider consolidating your debt into lower-interest loans or credit cards to make your payments more manageable.

Section 4: Boosting Your Income

Increasing your income is a proactive approach to achieving financial goals faster. It provides additional resources to save, invest, and pay off debt.

Side Hustles and Freelancing In today's gig economy, opportunities for side hustles and freelance work abound. Whether it's driving for a rideshare service, offering consulting services, or starting an online business, additional income streams can significantly enhance your financial situation. This extra income can be directed towards debt reduction, savings, or investments, accelerating your journey towards financial stability.

Investing in Yourself Your most valuable asset is yourself. Investing in your education and skills can have long-term benefits for your career and earning potential. Consider taking courses, attending workshops, or gaining certifications in your field. Continuous personal and professional development not only enhances your employability but also opens doors to higher income opportunities.

Section 5: Reducing Expenses and Saving Money

Reducing expenses is akin to tightening the bolts on a well-oiled machine. Every bit of savings contributes to smoother financial operations and long-term stability.

Cutting Unnecessary Costs Take a critical look at your spending habits and identify unnecessary expenses. Cancel subscriptions you no longer use, cook at home instead of dining out, and find ways to save on utilities and other monthly bills. Small changes in your spending habits can accumulate into significant savings over time.

Smart Shopping Adopt smart shopping strategies to maximize your savings. Compare prices, use coupons, and take advantage of sales to save money on everyday items. By being a savvy shopper, you can stretch your dollars further and make your budget work more efficiently.

Conclusion

Achieving financial stability requires a combination of smart spending, wise investing, and proactive debt management. By following these tips and staying committed to your financial goals, you can build a secure future and achieve long-term financial health. Remember to stay informed, adapt to changing circumstances, and celebrate your progress along the way.

Additional Resources

Consider consulting a financial advisor for personalized advice and guidance.

Utilize budgeting and investment apps to track your progress and stay on top of your finances.

Continuously educate yourself on personal finance and investing to make informed decisions.

In the grand tapestry of life, your financial health is a thread of paramount importance. With knowledge, discipline, and strategic planning, you can weave a future of stability, security, and prosperity.

Call to Action

Are you ready to take control of your financial future? Join our community at [Your Blog Name] for more in-depth articles and resources on financial management, investing, and achieving financial freedom. Don't forget to subscribe to our YouTube channel, [Unplugged Financial], where we dive into the history of money, explore the current financial landscape, and discuss how Bitcoin can revolutionize the financial world. Together, we can navigate the path to financial independence and create a brighter future.

Stay Connected:

Visit our blog: Bitcoin Revolution

Subscribe to our YouTube channel: Unplugged Financial

Let's learn, grow, and achieve financial freedom together!

#FinancialFreedom#MoneyManagement#InvestingTips#DebtFreeJourney#PersonalFinance#Budgeting#FinancialAdvice#SmartInvesting#EmergencyFund#SideHustles#FinancialStability#WealthBuilding#CryptoRevolution#Bitcoin#FinancialLiteracy#MoneyMatters#SaveMoney#IncreaseIncome#FrugalLiving#FinancialGoals#financial education#financial empowerment#financial experts#cryptocurrency#digitalcurrency#blockchain#finance#unplugged financial#globaleconomy

5 notes

·

View notes

Text

I’m 10,000 dollars in debt so moving forward I’m going to be posting about my journey to becoming debt free with 850 credit score . Also , about having a Huge savings account.

Here are some essential skills to help me and you if you are going through this to achieve this goal:

1. Budgeting: Create a realistic budget that accounts for every dollar spent.

2. Debt Snowball: Prioritize debts by focusing on the smallest balance first.

3. Debt Avalanche: Prioritize debts by focusing on the highest interest rate first.

4. Expense Tracking: Monitor and record every expense to identify areas for reduction.

5. Savings: Build an emergency fund to avoid further debt.

6. Credit Report Analysis: Understand your credit report and dispute errors.

7. Credit Utilization: Keep credit card balances below 30% of the limit.

8. Payment Planning: Make consistent, on-time payments.

9. Interest Rate Negotiation: Contact creditors to negotiate lower rates.

10. Credit Score Monitoring: Regularly check your credit score to track progress.

11. Financial Discipline: Avoid new debt and impulsive purchases.

12. Income Increase: Explore ways to boost income, such as a side hustle or raise.

13. Debt Consolidation: Consider consolidating debt into a lower-interest loan.

14. Credit Card Management: Use credit cards responsibly and pay off balances.

15. Long-term Planning: Set financial goals and develop a plan to achieve them.

Additionally, consider the following strategies to raise your credit score:

1. Pay bills on time (35% of credit score)

2. Keep credit utilization low (30% of credit score)

3. Monitor credit report errors (10% of credit score)

4. Don't open too many new credit accounts (10% of credit score)

5. Build a credit history (15% of credit score)

Remember, paying off debt and improving your credit score takes time and effort. Focus on developing these skills and staying committed to your goals. Paying off $10,000 in debt and raising your credit score to 850 requires discipline, patience, and a solid understanding of personal finance. Stay tuned to see me accomplish this easy goal and save triple that amount in savings

#budget#money#finance#sucessful#rags to riches#850creditscoreclub#bible#god#self care#christianity#jesus#self help#self improvement#becoming that girl#black love#boyfriend#husband#black marriage#motherhood#mother

3 notes

·

View notes

Text

### 📜 Overview of the "One Big Beautiful Bill" (OBBB)

The **One Big Beautiful Bill Act**, signed into law by President Trump on July 4, 2025, is a $4.5 trillion legislative package combining tax cuts, defense spending, border security, and social program reforms. It aims to extend Trump’s 2017 tax cuts while adding new provisions, funded partly by $1.5 trillion in spending cuts to health and welfare programs. Key goals include stimulating economic growth, strengthening border security, and promoting fossil fuel production.

---

### 💰 Where the Spending Goes

#### **Tax Cuts ($4.5 Trillion)**

- **Permanent TCJA Extensions**: Lower marginal tax rates, expanded child tax credit ($2,200/child), doubled standard deduction ($31,500 for couples), and 20% pass-through business deduction .

- **New Temporary Breaks**:

- No tax on tips (capped at $25,000) and overtime pay ($12,500 cap).

- Senior bonus deduction ($6,000 for those earning <$75,000) .

- **Corporate Incentives**: Full expensing for R&D and capital investments, Opportunity Zones extension .

#### **Spending Increases ($400+ Billion)**

- **Border Security**: $46.5B for border walls, $45B for detention centers, $30B for ICE staffing .

- **Defense**: $153B for shipbuilding, missile defense, and nuclear deterrence .

- **Energy**: Incentives for oil/gas leasing; termination of EV tax credits.

#### **Spending Cuts ($1.5 Trillion)**

- **Medicaid**: Work requirements (80 hrs/month for childless adults), frequent eligibility checks. *Impact: 11.8M lose coverage* .

- **SNAP**: States with high error rates pay up to 15% of costs; stricter work rules. *Impact: 5.3M families lose benefits* .

- **Clean Energy**: Repeal of Inflation Reduction Act credits for EVs and renewables .

*Table: Major Spending Allocations*

| **Category** | **Amount** | **Key Provisions** |

|--------------------|------------------|-----------------------------------------------|

| Tax Cuts | $4.5 trillion | Permanent TCJA extensions, new tip/overtime deductions |

| Border Security | $121.5 billion | Wall construction, detention expansion, ICE staffing |

| Defense | $153 billion | Shipbuilding, missile defense, nuclear weapons |

| Social Program Cuts| $1 trillion+ | Medicaid work rules, SNAP cost-sharing |

---

### 📊 Implications for the US Economy

#### **Growth and Investment**

- **Short-Term Boost**: GDP projected to rise 0.5–1.0% (CBO/Tax Foundation) from consumer spending and capital investment .

- **Long-Term Uncertainty**: Models show GDP declining by 1.5–2.9% by 2054 due to debt-driven crowding out of private investment .

- **Business Expansion**: Full expensing for factories/R&D may boost manufacturing, but clean energy rollbacks could hurt renewables .

#### **Labor and Inequality**

- **Winners**: Tipped workers ($1,300/year savings), seniors ($1,400+ relief), high earners (estate tax exemption up to $30M) .

- **Losers**: Low-income households face Medicaid/SNAP cuts; 17M could lose health coverage .

#### **Inflation and Wages**

- **Risks**: Deficit spending could fuel inflation, offsetting wage gains (projected up to $7,200 for workers) .

*Table: Economic Projections*

| **Source** | **GDP Impact (10-Year)** | **Deficit Impact** |

|--------------------|--------------------------|----------------------------|

| Tax Foundation | +1.0% (Senate version) | +$2.4 trillion (primary) |

| CBO | +0.5% | +$3.3 trillion (with interest) |

| Penn Wharton | -1.5% by 2054 | +$3.4 trillion |

---

### 🌍 Global Economic Implications

- **Trade Tensions**: "America First" tariffs (e.g., aluminum, steel) may trigger retaliatory measures .

- **Energy Markets**: Fossil fuel incentives (oil/gas leasing) could weaken global clean energy transitions .

- **Investment Shifts**: Corporate tax breaks may attract foreign capital to the U.S., but remittance taxes ($10B excise tax) could reduce cross-border flows .

---

### 🏦 Debt and Interest Rate Impacts

- **Deficit Surge**: Adds $3.3–$3.4 trillion to U.S. debt over 10 years, lifting debt-to-GDP to **124% by 2034** (CBO) .

- **Interest Costs**: Higher borrowing could increase rates by 0.5–1.0 point; interest payments rise by **$441 billion** .

- **Debt Ceiling**: Raised by $5 trillion to avoid 2025 default, but long-term sustainability concerns persist .

---

### 💎 Conclusion

The OBBB delivers short-term economic stimulus through tax cuts and defense spending but risks long-term instability via soaring debt, inequality, and reduced social safety nets. While businesses and higher earners benefit, low-income households face coverage losses, and global partners may confront trade and climate policy headwinds. Its legacy hinges on whether growth can outpace compounding deficits .

For further details, refer to:

- [Tax Foundation Analysis](https://taxfoundation.org/blog/big-beautiful-bill-impact-deficit-economy/)

- [CBO Cost Estimates](https://www.crfb.org/blogs/breaking-down-one-big-beautiful-bill)

- [BBC Policy Breakdown](https://www.bbc.com/news/articles/c0eqpz23l9jo)

0 notes

Text

Breaking Down Corporate and Business Restructuring for Business Setup in the UAE

In the fast-evolving business environment of the UAE, companies must stay agile to remain competitive and sustainable. Restructuring, whether at the corporate or business level, is one of the most effective strategies organizations use to adapt to market changes, optimize operations, and improve financial performance.

This blog explores the differences between corporate restructuring and business restructuring, providing clarity on their roles, components, and benefits for companies operating or setting up in the UAE.

Corporate Restructuring: A Strategic Overhaul

Corporate restructuring refers to large-scale changes made at an organizational or financial level. These changes often affect the entire company and may involve mergers and acquisitions, joint ventures, ownership changes, or financial reorganizations such as debt restructuring.

In the UAE, businesses often pursue corporate restructuring to stay compliant with changing laws, improve market positioning, or prepare for expansion. Key examples include:

Mergers, acquisitions, or divestitures

Leadership transitions or changes in ownership

Equity recapitalization or debt restructuring

Corporate restructuring is typically long-term and strategic, focusing on sustainability, competitiveness, and alignment with global best practices.

Business Restructuring: Operational Efficiency at the Core

Unlike corporate restructuring, business restructuring zooms in on specific departments or functions within an organization. It’s often driven by the need to cut costs, improve efficiency, or address performance issues. Common forms of business restructuring include:

Downsizing or departmental realignment

Outsourcing functions or shifting supply chain models

Streamlining product lines or services

Operational vs. Financial Restructuring

Restructuring can also be broken into operational and financial categories.

Operational restructuring targets inefficiencies optimizing workflows, reallocating resources, and boosting productivity.

Financial restructuring involves capital structure changes such as refinancing, equity swaps, or asset sales to stabilize finances.

Most restructuring efforts blend both aspects to address both internal performance and external financial health.

Why Restructure?

Companies restructure for a variety of reasons beyond just financial distress. Strategic growth, market realignment, mergers, debt reduction, or expansion into new sectors often trigger the need for change. When done proactively, restructuring becomes a tool for strengthening competitive advantage.

Steps in the Restructuring Process

The typical restructuring process includes:

Internal assessment of performance and financial health

Strategic planning with expert consultants

Implementation of structural or operational changes

Transparent communication with stakeholders

Continuous monitoring and adjustment

Legal and financial compliance

Challenges to Watch For

Despite its benefits, restructuring can lead to employee uncertainty, short-term disruptions, and high costs if not managed properly. Mitigating these risks requires careful planning, clear communication, and guidance from experienced advisors.

Considering restructuring or setting up your business in the UAE?

Learn how expert-led strategies in corporate and business restructuring can strengthen your company's future.

Read the full article on our blog at [Nimbus Consultancy].

0 notes

Text

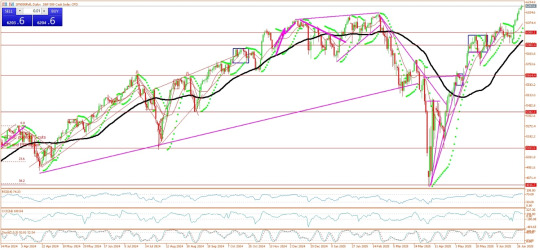

Wall Street Hits New Highs, NFP on Thursday

US stocks ended higher on Monday, with both the S&P 500 index and Nasdaq Composite hitting fresh record highs at the end of a positive month and second quarter as fears over global trade wars receded further.

All three benchmark indexes were boosted by the announcement at the end of last week of a trade agreement between the US and China, lifting hopes that a deal could be reached before President Trump’s July 9 deadline.

Trade deal hopes were further raised by news on Monday that Canada had rescinded its digital services tax on tech businesses mere hours before it was due to take effect, as Ottawa tries to restart stalled negotiations with the Trump administration.

Canadian Prime Minister Mark Carney and President Trump will now hold talks with the goal of reaching a trade deal by July 21, Canada’s finance ministry said.

Markets were also supported by rising expectations of a Federal Reserve rate cut, spurred by weaker-than-expected inflation data last week.

Friday’s personal consumption expenditures (PCE) report showed that consumer spending unexpectedly declined in May, though the central bank’s preferred inflation rate remained stubbornly above the Fed’s 2% target.

Financial markets are now pricing in a roughly 74% probability that the Fed will slash rates as soon as its September, although there is still a smaller chance that the next reduction comes at its next gathering in July.

The latest non-farm payrolls report will be released on Thursday this month, with Friday being the US Independence Day holiday. Economists anticipate that a total of 120,000 jobs were added in June, down from 139,000 in May.

Meanwhile, President Trump’s comprehensive “One Big Beautiful Bill”, combining tax cuts, domestic spending changes, and border security provisions narrowly moved forward in the Senate on Saturday, with a 51–49 procedural vote to open a debate on the bill’s advancement.

Senate Republicans are aiming to wrap up the approval process before the July 4 holiday, but the bill faces further hurdles as members have raised objections to the deficit impact and rushed timeline. The Republican-controlled House of Representatives passed its version of the bill last month.

On foreign exchanges, the US dollar continued to retreat in the face of interest rate cut possibilities and worries over the impact of Trump’s “One Big Beautiful Bill” on government debt levels. The dollar index, which tracks the greenback against a basket of six other currencies, lost 0.6% to 96.79.

Meanwhile, precious metal prices were supported by a weaker dollar, though safe-haven demand stayed muted amid easing Middle East tensions and optimism over potential US trade deals. Spot gold gained 0.9% to $3,304 an ounce. Spot silver added 0.3% to $36.02 an ounce.

At the stock market close in New York, the blue-chip Dow Jones Industrials Average (DJIA) was up 0.6% to 44,094, while the broader S&P 500 index added 0.5% to 6,204, and the tech-laden Nasdaq Composite rose 0.5% to 20,369.

SPX500Roll Daily

The S&P 500 posted its largest quarterly percentage gain since the fourth quarter of 2023, and the Nasdaq Composite had its best quarter in five years.

Among the tech gainers, Oracle rose 3.8% after announcing that it had signed multiple deals to provide services to large cloud providers, with one of the agreements expected to bring in more than $30 billion in annual revenue from 2028.

Meta Platforms added 0.6% as investors digested media reports suggesting that the Facebook and Instagram firm has hired four AI researchers from OpenAI to join its Superintelligence group.

And Robinhood Markets jumped 12.8% to record highs after the company announced a number of new crypto-related offerings that will be launched on the platform for users to trade.

Elsewhere, Goldman Sachs gained 1.9% and Wells Fargo added 0.8% after the Federal Reserve said late on Friday that America’s largest banks had cleared its annual stress test.

USOILRoll H1

Elsewhere, oil prices dropped on Monday, extending falls after its sharpest weekly decline since March 2023 amid easing tensions in the Middle East and the possibility that OPEC+ will further increase its oil output.

Reports indicated that OPEC+ was set to boost output by 411,000 barrels per day in August, following a similar hike already planned for July.

US WTI crude futures shed 0.7% to $65.09 a barrel, and UK Brent crude futures lost 0.2% to $66.67 a barrel.

Disclaimer: The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions. Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us. The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Brazil President Lula Set to Unveil Budget Plan That Won’t Please Anyone

Brazil President Luiz Inacio Lula da Silva is set to release a budget plan for next year that is likely to displease both financial markets and his leftist political allies.

The proposal, which the government plans to unveil Friday, neither includes the amount of new investments Lula’s Workers’ Party wants to boost growth nor the structural spending reductions that will produce the decline in public debt sought by investors, according to people with knowledge of the matter.

Put together, it risks to increase scrutiny of Finance Minister Fernando Haddad, who has already scaled back government ambitions of a surplus in 2025.

Brazil’s fiscal policy represents a flashpoint between Lula’s administration and nervous financial markets, with broad repercussions for the economy. Spending concerns weigh on local assets and dragged the real toward a record low this year. While the government has vowed to improve the lives of ordinary citizens through greater expenditures, investors blame the extra outlays for spurring inflation and setting the stage for interest rate hikes as soon as next month.

Continue reading.

2 notes

·

View notes